While indicators for investing in the stock market tend to be metrics like acceptable P/E ratios and Interest rates, the case for an emerging and technologically defined market such as cryptocurrencies is different.

An analyst from JP Morgan suggested the indicator for a Bull run for Bitcoin to be the coin’s market share as a percentage of total cryptocurrency market-cap surpassing 50% or more.

Bitcoin has a market capitalization of 45% today, only because people in consensus believe it has value. On basis of fundamentals such as Transactions Per Second (TPS), Transaction Costs, Usability, and Ecological Costs, Bitcoin is technologically backward relative to the majority of other cryptocurrencies (Altcoins).

Examples such as follows

- Proof of Stake-based Cryptocurrencies such as Cardano and Algorand are environment friendly, consuming almost no energy to run the transaction network.

- Algorand has a transaction speed of 1000+ TPS compared to Bitcoin’s 7 TPS.

- In addition to functioning as a digital currency, Ethereum has more usability, such as smart contracts and decentralized applications.

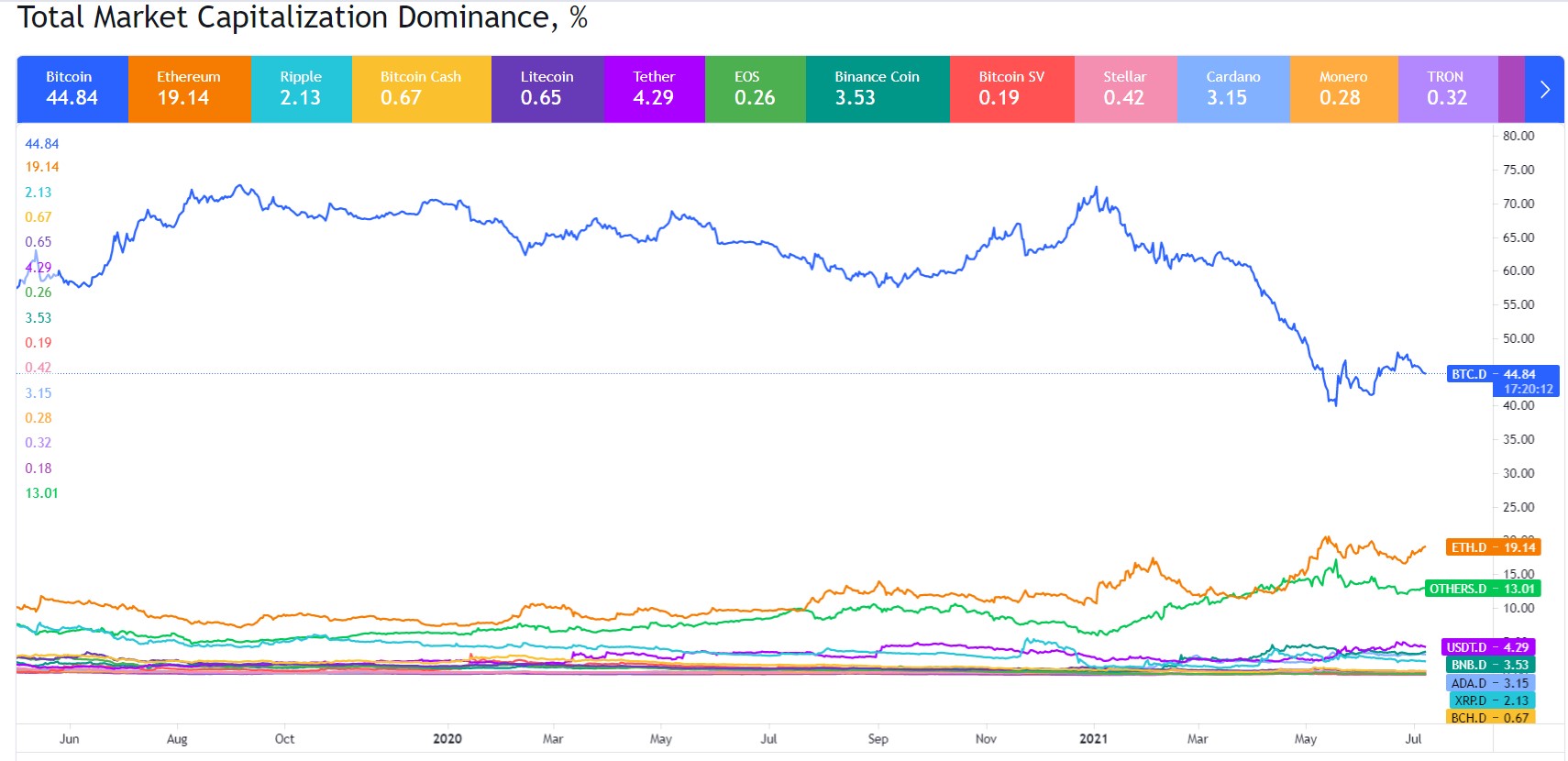

In the above image, it can be seen that Bitcoin has experienced a significant decline in market share, from 65% range throughout the last year to 45% range today, while Ethereum’s market capitalization has increased a little over double, from 9% to 20%. Other cryptocurrencies such as Cardano (ADA) and Binance Coin (BNB) have also tripled in market share from ~1% to 3%+.

In addition, the number of cryptocurrencies has risen significantly over the last half-decade, rising from 5,000 to 10,000+.

On comparison of the two largest currencies, although Ethereum’s fundamentals aren’t as strong compared to other cryptocurrencies such as Algorand and Cardano, it is a relatively better option to Bitcoin; not to forget the large potential of ETH2.0 (Basically, an upgrade which will make it highly efficient). So, if Bitcoin investors decide to switch from BTC to ETH, the relative market share of Bitcoin can continue to spiral downwards, while the Altcoin market significantly expands.

There is a possibility that countries like El Salvador (Where Bitcoin is legal tender) realize that the other cryptocurrencies have much more potential, usability, and lower costs, to battle their existing problems such as difficulties experienced by Salvadoreans abroad trying to send money home.

Bitcoin has a correlation of ~0.75 (Significant) with Alt-coins. Historically, Bitcoin has been the majority holding in most crypto-holdings in financial institutions. It is sort of like “We’ll get into Bitcoin first, and then see how it goes from there”. However, recent rebalancing of digital asset funds such as Grayscale Digital Large Cap Fund reducing Bitcoin’s portfolio weight from 80% to 70% may support with conviction that the Altcoin trend has started.

Lastly, in today’s volatile crypto market, most alternate currencies behave like a 2x leveraged version of Bitcoin. thus with Bitcoin rising a certain percentage, alternate currencies may rise either proportionately or more. Thus,

My take: In my opinion, the market share of altcoins is set to rise, and although Altcoins and Bitcoin share a symbiotic relationship where both grow or fall, Bitcoin, being fundamentally flawed can eventually end up falling or stagnating in market share. One important aspect to remember about Altcoins is that with higher potential reward, don’t forget that your overall crypto-portfolio volatility will double if you switch from Bitcoin to Altcoins. I also believe that the fundamentals of Altcoins will be strong enough within this decade to prove as an efficient competitor with respect of transactional efficiencies of Fiat currencies.

Disclosure: I am not a financial advisor and none of the information stated above is to be considered as financial advice. This article is solely my opinion, and written only for educational purposes, I invest on my own due diligence, and as should everyone.