A risk you should know about.

SEC filings – All you need to know.

Let’s learn! – What are the 10-Ks, 10-Qs that you hear of in the news? This guide is useful for beginners tracking the US markets.

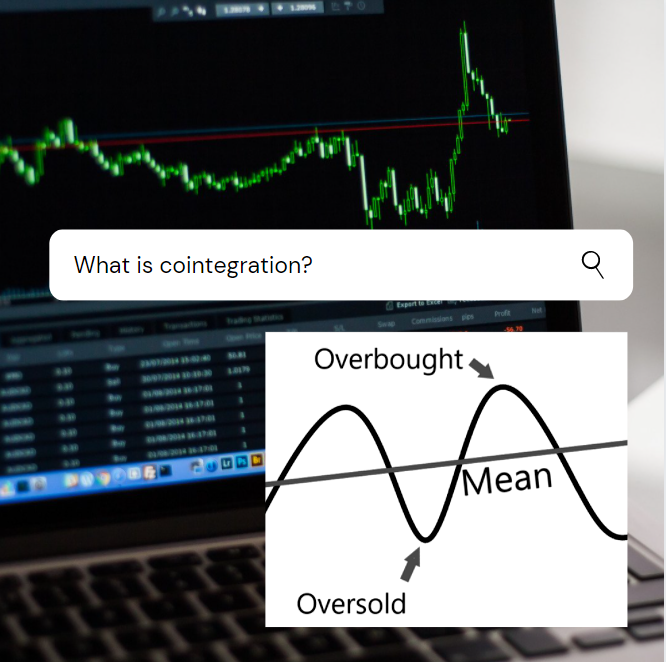

Cointegration Demystified

An intuitive explanation of one of the most important statistical concepts in Quantitative Finance.

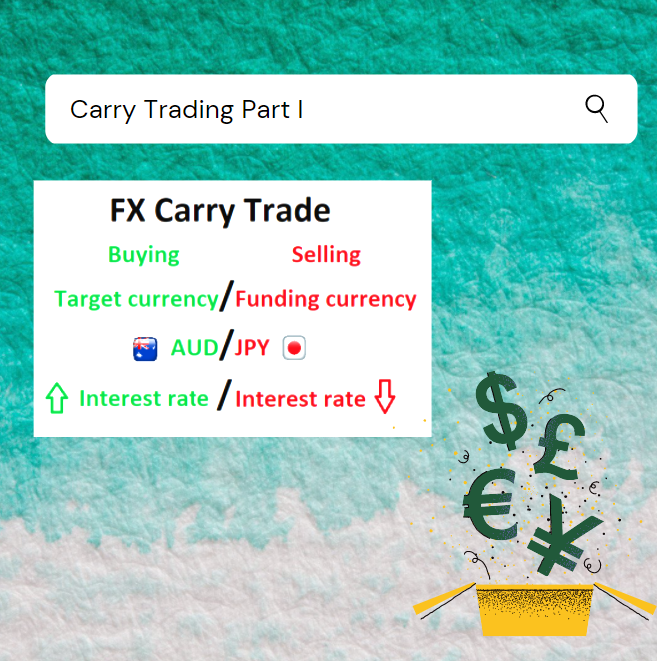

Dynamic Trading Strategies

Dynamic trading strategies are quantitative strategies which quickly adapt to changes in market variables.

Big Data

Big Data – the lifeblood for quantitative trading strategies is a buzzword for large amounts of data.

Quantitative Trading

Quantitative trading involves using math and Big Data to develop trading strategies.