Amidst the COVID-19 pandemic, should you be adding the crypto eggs to your basket?

Background:

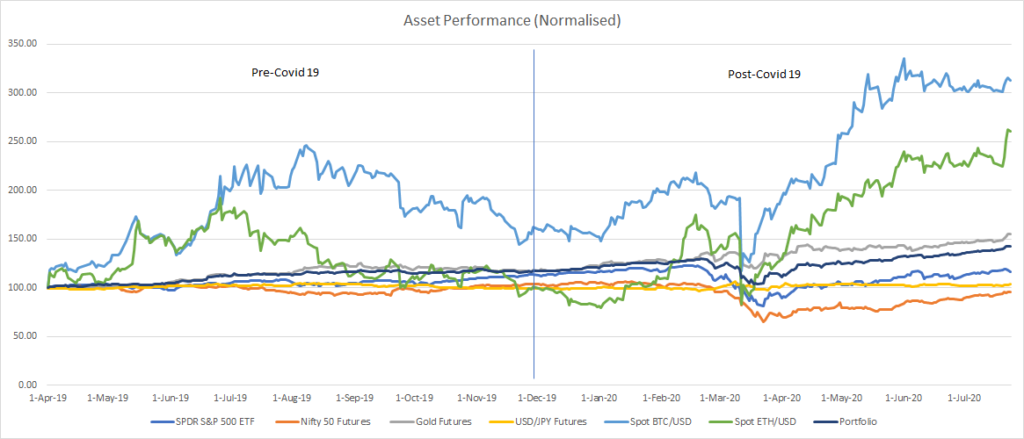

Due to a soured economic outlook induced by the global pandemic, cross-asset correlations, systematic risk and downside volatility of investment assets increased. This led to the simultaneous crash across assets in mid-March. Data analysis revealed that holding cryptocurrencies would have preserved wealth during the crisis. Furthermore, a rule of thumb 60:40 allocation across risky and safe haven assets¹ – which amounts to 30% for crypto – would have outperformed that generated from a Markowitz optimisation² of the portfolio’s Sortino ratio³ by around 1.4 times.

Methodology:

A global portfolio was constructed consisting of stock index ETF/futures (SPDR S&P 500 and Nifty 50), traditional safe havens (Gold futures and the Japanese Yen) and popular cryptocurrencies (Bitcoin and Ethereum). The performance of the portfolio was analysed for an 8 month period before and after the Covid 19 outbreak on 1st Dec 2019 – the day when it was identified in Wuhan, China. The tools used for analysis are the mean variance optimization framework, correlation, beta, Sharpe and Sortino ratios.

Findings:

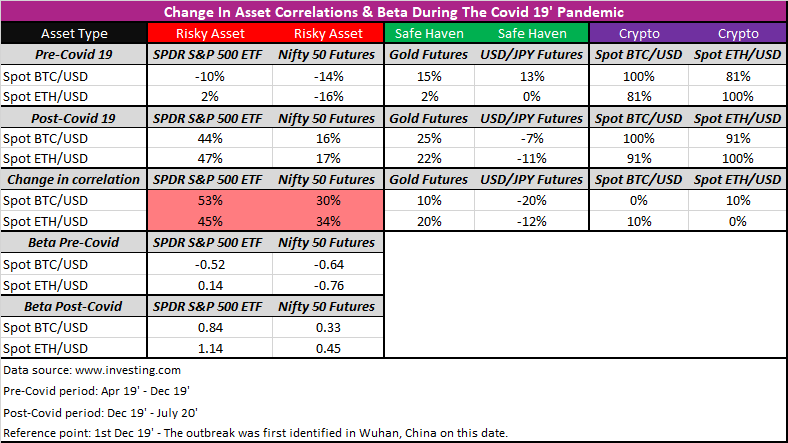

Cryptos as a safe haven – If cryptocurrencies were to qualify as safe havens, they would be expected to have low correlations⁴ with traditional risky assets and either maintain or increase in value during stressed market periods. Since the outbreak, the once negligible, negative correlations between the cryptocurrencies and stock indices have reversed in direction, increasing by 30-50%, that between Bitcoin and S&P 500 reached 53%. The betas reflect the same. The higher positive correlations led to increased portfolio risk. However, as shall be apparent by the end of this article, this does not rule out the case for adding crypto investments to the portfolio.

The Bitcoin-Altcoin connect – It is interesting to note that the correlation between Bitcoin and Ethereum increased further by 10%, from around 81% to 91%. This serves as a reminder that intra-crypto diversification – between Bitcoin and altcoins – should also be explored in future research since their correlations seem to increase during times of market stress.

Crypto trading implications – The increased correlations also have an important implication for standalone crypto trading. There is growing acknowledgement between crypto traders that cryptos are increasingly tracking the S&P 500 these days. This means that traders must also factor in the broader market sentiment in their trade decisions (for non-market neutral strategies).

The new relationships could also be used to counter the argument that cryptocurrencies do not have any fundamentals. One could argue, for example, that cryptos derive their values from international crypto transactions and an unfavourable economic outlook and a fall in consumer spending does not bode well for them.

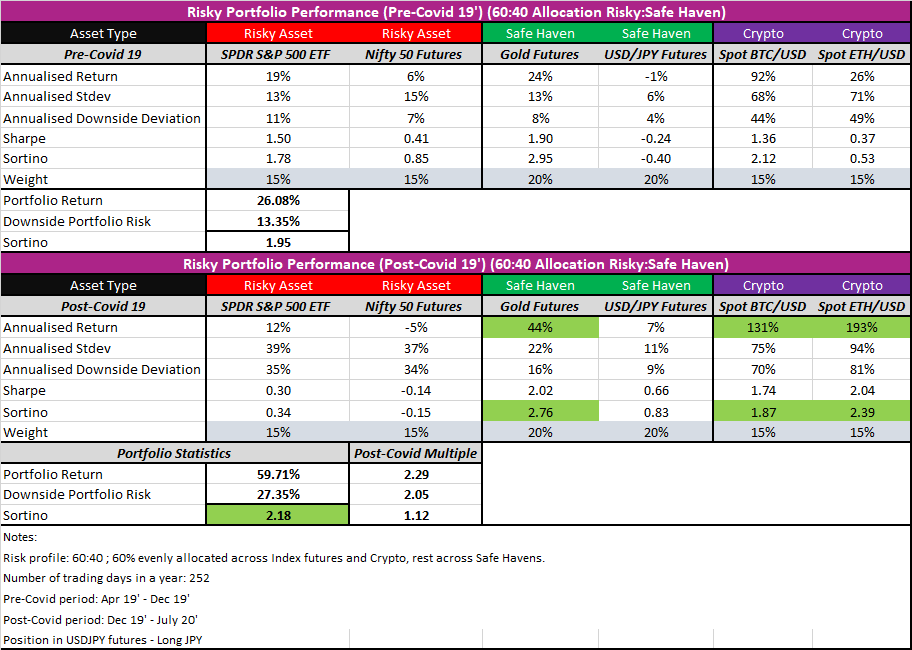

Crypto allocation – Case A – Consider a rule of thumb 60-40 allocation to risky assets and safe havens, with an equal distribution within the two categories (15% across both the stock indices and cryptos, 20% across safe havens). Due to the increased correlations and market volatility, the downside portfolio risk increased by 2x. However, the return from the portfolio, led by the massive crypto returns and gold living up to its safe haven potential, increased by 2.3x. The Sortino ratio increased from 1.95 to 2.18, which is a decent result for an investment portfolio, especially during a stressed market period.

Since the outbreak, Bitcoin is up by 131%, Ethereum by 193% and Gold futures by 44%. The return from these assets more than compensated for their increased downside risk and cross-asset correlations.

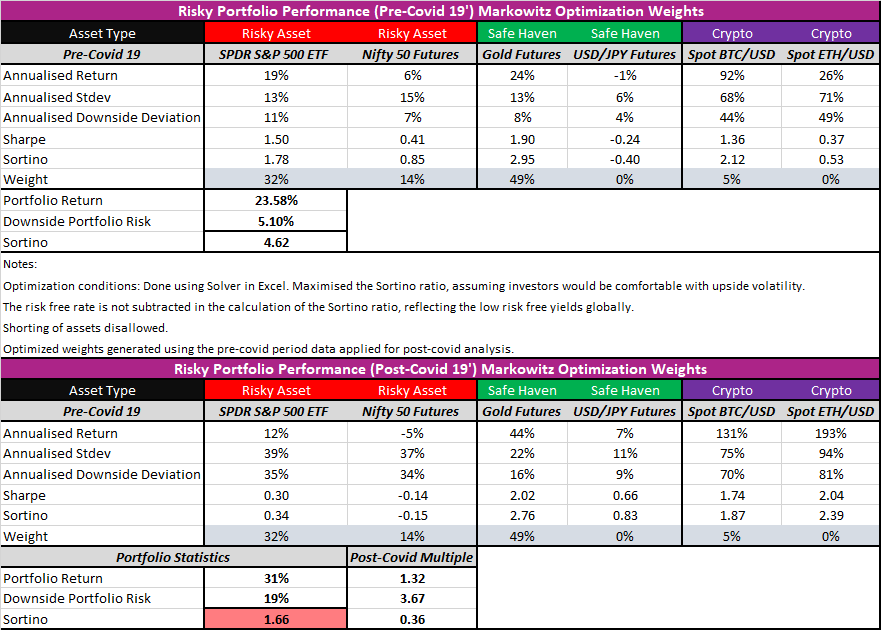

Crypto allocation – Case B – We checked whether allocations made according to a mathematical optimization could have generated a better result over the rule of thumb. The optimization was run on the pre-covid data set with the objective of maximising the Sortino ratio. These weights were then applied to the post-covid dataset.

The optimization result is a 51-49% split between the risky assets and safe havens. Amongst the risky assets, the max allocation is 32% to S&P 500 while the least is 0% to Ethereum, which had the highest downside volatility. The total crypto allocation was only 5% in Bitcoin. Amongst the safe assets, the entire amount was allocated to Gold futures.

The optimization failed to produce a superior Sortino ratio in the post crisis period as compared to the 60-40 case. The reduced allocation to crypto missed out on the rally in both the cryptos, especially Ethereum in its entirety, leading to an erosion of the portfolio value. Clearly, the optimization weights were not optimal for a period of market stress.

Interestingly, the portfolio risk increased by 3.7x – almost double than in the 60:40 case – while the return was half than in the 60:40 case during the outbreak. The Sortino ratio fell to 1.66 post crisis from 4.62 pre crisis; this is much lower than that in the 60:40 case – a ratio of 1.95 pre-covid and 2.18 post-covid.

Conclusions:

Past returns may not repeat themselves. However, it is worth giving some thought to holding cryptocurrencies as part of an investment portfolio. During periods of market stress, their downside volatility and correlation with the broader market may increase, however, the diversification benefit could help preserve portfolio value and the increased risk may be offset by higher returns. Intra-crypto diversification could also be explored for further risk management.

We found that a 30% allocation to cryptos significantly aided portfolio performance during the crisis, up until now. This allocation could be adjusted upward or downward based on an investor’s risk appetite, however, if it is kept too low, the diversification benefit is lost. If kept too high, it would increase portfolio risk.

The same research could be replicated for other stressed periods in the past and updated with future data, to test the robustness and validity of these findings. For making an informed market entry, we recommend that this research be complemented with the study of crypto asset valuation and/or price action over a longer time horizon.

Footnotes:

¹A safe haven, as the name implies, is an investment which retains or increases its value during times of market turbulence.

²The Sortino ratio is a measure of risk adjusted return where the risk is only downside volatility; the Sharpe ratio considers both – upside and downside volatility.

³This is a mathematical optimisation procedure, also referred to as the mean variance framework; it iteratively finds the optimal portfolio allocations given the data inputs of individual asset returns, volatilities and cross-asset correlations and an optimisation objective such as maximise portfolio return or minimise portfolio risk.

⁴The correlation coefficient measures the extent to which two assets move together. The value can range between -1 and 1 with 1 indicating perfect positive correlation and -1, a perfect negative correlation.